Welcome to My Investing Blog

“All the math you need in the stock market you get in the fourth grade”

– Peter Lynch

Hello everyone and welcome to my new trading blog where I share my upcoming picks and trading ideas each week. Follow me on my trading journey where I will dive into ideas from a technical and fundamental standpoint as well as offer my personal opinion on various aspect of trading.

*Disclaimer: This blog is for educational purposes and should not be used to make investment decisions. Please consult with your financial advisor before making any decisions to buy or sell securities as there is a certain amount of risk involved with any investment.

Follow My Blog

Get new content delivered directly to your inbox.

If you appreciate this content and want to see more, feel free to donate to my CashApp: $BullMarket2. All donations go to improving the site.

10/12 – 10/16 Weekly Watch List:

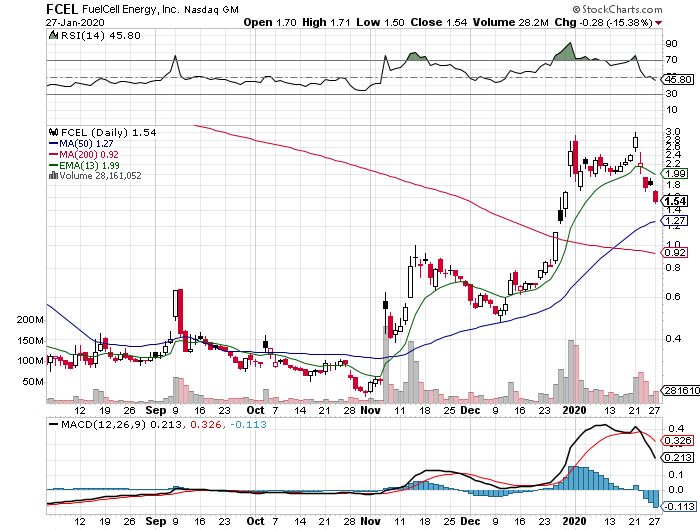

FCEL – Had some success trading this in the past. Gonna keep this short and simple, looking for this to hold above the 50ma (2.55) and have a slow and steady trend back to 3.00. Has a higher than normal float, so do expect dramatic pops but keep on watch this week as last week showed a slow trend up every day.

NBY – Just a watch for now since the daily chart does show steady consolidation near .75. Looking for key areas to break over such as the 200ma (.84) to confirm the “U” shape. May or may not happen this week but set alerts at .84 to start watching it closer.

RMED – Pretty low priced stock which is not necessarily a great sign; however, the daily chart shows a 13ema and 50ma squeeze forming so that is why I am focusing on this one. Key area to break is .32. With these tickers under .50 I typically don’t try to shoot for the stars unless volume is just insane. If it can squeeze and break over .32 I’m looking for a .40 PT.

10/5 – 10/9 Recap:

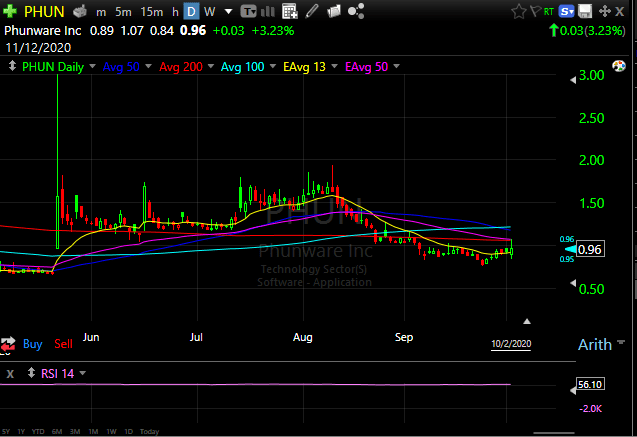

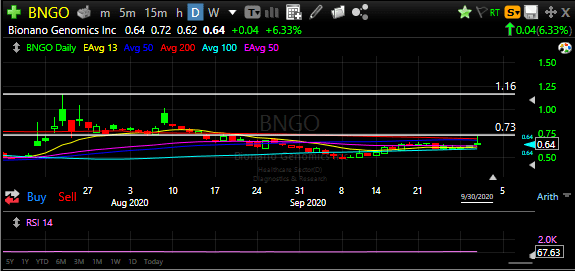

PHUN failed to rebreak over dollar again so had to bail on this one. I will still keep an alert in case volume moves back in, but for now it’s best to watch more viable plays during this time. Not much happened with the other swing set ups so just keeping on watch for now. However, AKBA from the week prior was the star of the week. From 2.49 original alert and closing at 3.59 for an approximate 2 week swing. Congrats if set alerts and took it. I ended selling early around 2.95 as I thought it wasn’t going to break over the 3.00 resistance, but ended up busting through on a Friday no less and continued a slow and steady trend even throughout after hours trading.

10/5 – 10/9 Weekly Watch List:

If you are in the market for great charting software at an affordable price, then I highly recommend TC2000. I have been using them for years and since then they have upped their game with custom scanners, easy to use charts, as well as alerts to remind you of critical areas to watch. Sign up using my link and get $25 off https://www.tc2000.com/download/txjustice

There is a 9/28 – 10/2 recap below this post.

PHUN – Originally alerted on twitter (@txjustice3), for the possible dollar breakout which happened right at the closing bell. However, took a little dive in after hours, but still holding a position for next week to see if we can reclaim a dollar and get more volume to move this past the 200ma (1.05). Stop loss will be under .85.

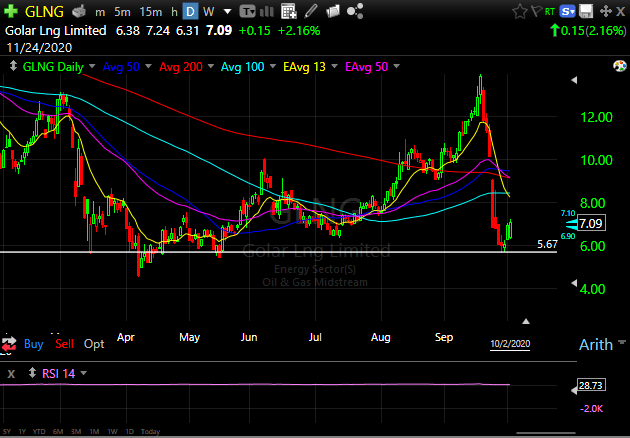

GLNG – A little risky since oil and gas is hit or miss right now, but the daily chart does present us with a “U” shape reversal off of bottom support. I’ll be monitoring this week to see how the price action plays out and if a continuation higher happens. If momentum flows in over 7.5 and holds, look for a test of the 13ema on the daily (8.24).

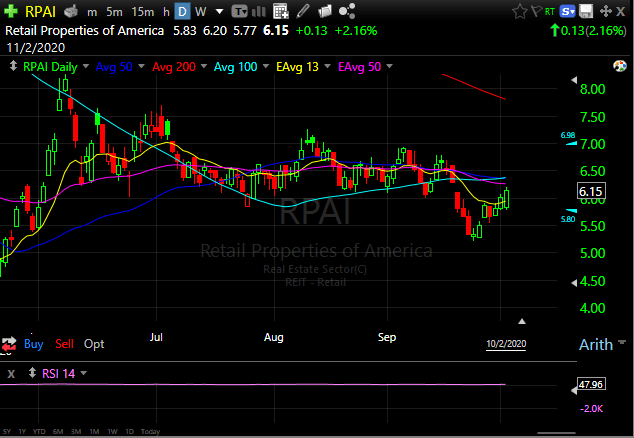

RPAI – This is another slow and steady trend that I have been preemptively monitoring. Everyday last week showed a higher high after breaking over the 13ema (5.94) and ultimately closing the week above 6.00. This will be on high watch for me as I want to see if momentum can push this over the 50ma (6.35). Once over that and shows its able to hold there is room to run to 7.80 (200ma).

ADTX – Fairly new ticker, but keep on watch for a pop over 2.01 (13ema) and a possible scalp opportunity until 2.96 (50ema). For now I would just keep this one on the back burner.

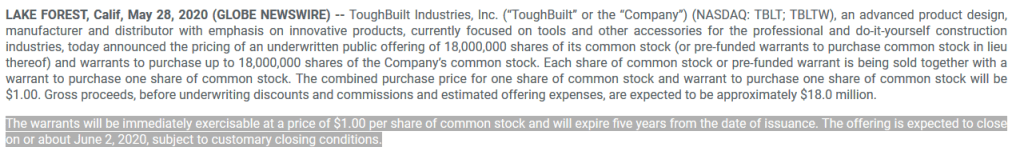

Weekly Recap: We had some decent winners from the short watch list posted. Let’s start with TBLT: From a low of .65 and closing out the week with a high of .85 I feel this is just the start. As mentioned during the weekly WL, this company seems to be turning over a new leaf with world wide expansion, the launch of their tool line, maintaining current big box retail and partnering with Lowe’s Home Improvement to manufacture their soft storage line under the Kobalt brand. I expect this ticker to get well over a dollar as the offering from May 28, 2020 states:

So with warrants exercising at $1 I can only make a safe guess that all of the participants in the offering want a greater return on their investment. As always stick to your risk assessment, but if you took it from the watch list you should have a nice profit cushion by now. Friday closed right above the 100ma on the daily chart and once over 1.00 there is room to run to 1.32 (200ma).

AMD was another one on the watch list that had some pretty decent gains from $82 area testing a high of $85.25. Even with the volatility of the SPY last week, AMD went right as planned where both the 83c and 85c gave great gains. If you are new to the options game or just curious, I highly recommend checking out Rapid Financial (Twitter: @RapidTrading) who has helped me out a lot in my options journey. He definitely knows the game and backs it up with real time alerts that deliver.

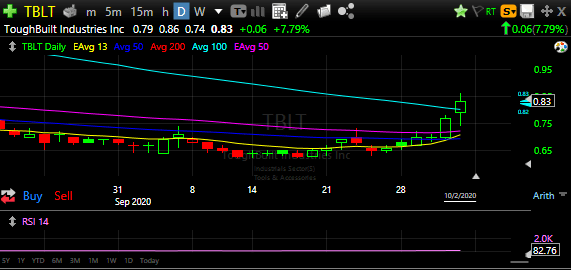

Others: Slowly adding to BNGO on dips and monitoring AKBA for over 2.60 area.

9/28 – 10/2/2020 Weekly Watch List:

Well it’s been a while since I did one of these, but I figured it is time to get back in the saddle with swing trade alerts. I’ll be honest I fell of track with alerting due to lack of motivation, current events, life, and other things that come up during our journey through life. However, going forward I am making a diligent effort to stay on top of this blog not only for newer swing traders, but for myself. I understand a lot of the struggles and obstacles that come with achieving financial freedom because I was there myself (…and still am). My goal is to not feed individuals alerts but to share ideas using technical and fundamental analysis to allow you to make your own decisions regarding risk vs. reward, support/resistance, etc. With that being said, let’s get started:

BNGO – If you follow me on twitter, you know that I am very bullish on this ticker for a swing. Several positive developments such as their Saphyr Genome tech which enables ultra-sensitive and ultra-specific structural variation detection in genome analysis is an absolute game changer in my opinion. Recently there has been world wide adoption of Saphyr and constantly expanding into new markets. This allows labs to use cytogenomic analysis at a rate faster than current conventional methods which can help to detect genetic diseases, leukemias and solid tumor early on. From a technical standpoint, the daily chart has been rebounding this week even touching the 200ma (.69). Areas of resistance are .69, .73, before attempting to break over a dollar. There are some cons, however, as the stockholders just approved a proxy proposal to increase the authorized share count, but this is typical of a growing company and is often used as a last resort measure. I believe that with the recent addition of Chris Stewart as CFO who also served as Head of the Maxwell Ultracapacitors business unit at Tesla will only propel the company forward.

TBLT – Not exactly the biggest fan of this ticker, nevertheless, it has formed a nice base on the daily chart and is showing signs of a reversal. Those who have followed me in the past know I have scalped this many times with relative success and a few failures. I do think the CEO is turning over a new leaf as he was able to obtain a pretty impress deal with Lowe’s Home Improvement to manufacture items under the in-house Kobalt line which estimates over $22 million in new business from Lowe’s. While I can’t say he is doing the most stand up job with regard to shareholder value, if the company can actually pull this off it will set them up for a nice spike before the end of the year. According to past PRs the launch is set to happen in October so keep this one on your back burner.

AMD – Yes, I know many of you that follow my swings like them due to the low stock price, but if you play these as options they can be just like trading pennies just remember that you are fighting time so risk accordingly. AMD is one that has been very rewarding for me during this whole coronavirus pandemic where we saw the stock go from $37 area lows to a staggering high of $94. This is definitely a company that is bringing their A game and I predict they will knock Intel out of the water soon. Everything about this company screams winner and I am throwing it out there that we could see a test of all time highs before the end of the year. I recently picked up pretty risky 83c (ex. 10/2) and 85c (ex. 10/9) as it appears the daily is curling back up for another U shape move. My game plan is to see it back over $83 tomorrow (10/1) and possibly test $85 before Friday if conditions are right. Under $81 is where I will have to cut.

AKBA – This one is a very speculative, bottom feeder play after the massive drop from $10 due to missed safety endpoints during phase 3 trials. I don’t usually swing these types of plays, but when they get volume they can provide decent scalps off the bottom with a favorable risk vs. reward setup. I am watching for over 2.5 area for a scalp to the 13ema on the daily chart (2.98). This is a good one to keep on your back burner and monitor activity.

5/26 – 5/29/2020 Weekly Watch List:

GHSI – This one has been getting a lot of attention recently and if you follow me on twitter you will know I alerted this one in real time during the break of .54. The key focus going into this week is maintaining the .54 support and building higher lows on the daily chart. The area of resistance to watch out for is .74; however, after this critical resistance the sky is the limit.

$HTZ – Just on watch for now as they officially filed for bankruptcy so expect a lot of volatility to pour in this ticker. The game plan is to take easy scalps throughout the week and to not be greedy! I will be watching how it trades tomorrow, but the key areas I will be focusing on for potential .10-.15/shares scalps are break over 13ema (3.11) and the 50ma touch (4.67).

CDEV – I really like this daily chart as it has maintained above the 13ema on the daily and has consistently held in the dollar range. Gap to fill play that is just now starting to fill with the next area of resistance at 1.49 and 1.86 (100ma). Keep on watch for the rest of the week as the chart is primed.

DMPI – Not exactly my favorite setup, but I have had it on my watch list for a while. I am not too thrilled about the high RSI (83.33), but the daily chart does show a potential for a dollar breakout with the next big area of resistance at 1.22.

5/11 – 5/15/2020 Weekly Watch List:

I’ve kinda been slacking writing these blogs while all this stuff has been going on, but I will make a more conscious effort going forward. Anyways, here are some setups that I am monitoring for the week:

LPCN – Gap to fill play that got some attention last week. Ideally, I am looking for the .75 break for a chance at a dollar breakout and possible 200ma (1.29) touch. No position as of yet as I am just watching to see how it trades going into the week.

DMPI – Played this one a lot in the past, but really haven’t paid much attention to it under $1. However, it has been on a steady trend since 5/5. What I am watching for is the break over the 200ma (.66) for continued momentum this week.

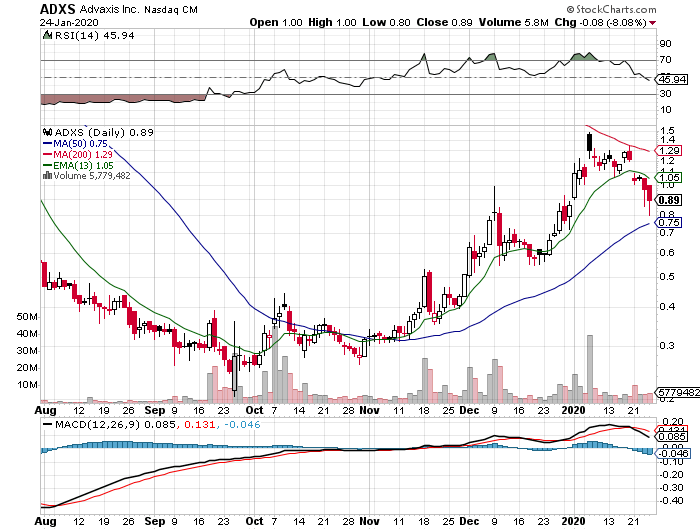

ADXS – Another one I haven’t played in a while, but these under $1 tickers have been hot lately so it is worth watching. Had this one on watch since the bottom bounce off .39. Kinda wish I set alerts on this one because it has been on an uptrend everyday last week, but looking for a break of .79 (100ma) for the real fireworks to start. Excellent swing setup with a chance at a dollar breakout.

TBLT – I hate this ticker due to the sketchy management; however, I will not deny the volume surge last Friday. We have seen it time and time again of post reverse split pops so be on the lookout as executive management might have finally realized that they have destroyed investor sentiment with countless toxic financing deals and offerings despite being able to secure huge deals with Lowe’s. Only time will tell, but I’m not holding my breath. I want to see over 1.84 (100ma) and then a steady climb over $2 to get excited.

AKRX – Looks to have consolidated a bit around .25 area after gaping down from the .50s. Closed right at the 13ema on the daily chart so worth watching to see if it can break and hold over for a climb to at least the 50ma (.46).

XOM – Options play. Last week it bounced off the 50ema (45.22) and held into after hours. I have alerts set for the possible r/g move over 47.68 for a shot at $50 retest.

4/20 – 4/24/2020 Weekly Watch List:

I guess I have been kinda slacking with these blog post during this whole lock down so I am making a effort to be more active going forward. I haven’t been seeing a whole lot of viable swing set ups that I like honestly and have just been either day trading or playing SPY calls and puts. With that being said here are a few tickers that caught my eye:

KTOV – I am still liking this one as the chart is still relatively intact. It was able to hold above support at .28 after taking a small dip due to the warrant exercise PR earlier in the week. Actually, I didn’t see this as a negative like some many traders that bailed did since this news plus the recent offering a while back sets them up with an abundance of cash. Not to mention that the company will launch their Consensi drug in May. This has already been approved by the FDA so the hard part is out of the way and Kitov’s manufacturing partners have completed the packaging, release and shipment of Consensi to its marketing partners. Keep this on watch going into May.

GRPN – If you follow me on twitter, I alerted this one in real time as we broke over $1. I thought we would get more momentum after breaking, but I am still happy with the close. I am already in and will be looking for a conservative price target of 1.20. Nothing too crazy since I have been taking profit when I have it during this whole pandemic.

FCEL – A fun ticker I have alerted in the past for a nice swing, but haven’t played it in a while. Just on the watchlist for now since the daily chart looks enticing. Seemed to get a nice pop into the 1.70’s and closed right above the 50ma on the daily chart (1.72). If momentum continues, we could see another move up towards $2. Keep on watch the rest of the week to see how it trades.

TBLT – Those that know me, know I legit hate this ticker! It is the poster child for “great product, shitty management.” The CEO knows absolutely nothing about public company financing and as a result has dug this company into the ground along with the “part time” CFO who has steered management into countless toxic financing deals. With that being said, I was impressed with the 22 million dollar Lowes deal they managed to secure unfortunately the manipulation was so strong that it really didn’t do anything for shareholder value. In my opinion, they should’ve waited to drop this gem until after the reverse split. Which brings me to my next point, now that the float is lower, between 10-13million, and if management can finally not constantly screw over existing shareholders, there is a chance at $2+. I have scalped this many times in the past, but I feel that maybe management realizes that trying to do everything all at once only kills business. Still on the fence, but I always seem to have this on my watchlist. Maybe I am a sucker for punishment but hopefully Michael Panosian can deliver on that promise of “increased shareholder value” he noted before.

3/23 – 3/27/2020 Weekly Watch List:

All I can say is HOLY S***! Thanks to the CCP Virus (Chinese Communist Party) the World is in complete chaos!!! I am not sure if you noticed, but markets took a bit of a tumble recently. I’m sure many of you all were panicking, not about the pandemic, but wondering if I’m ok due to my absent blog post. Rest assure I am fine and scalping plays like Jeffery Dahmer at midnight in Wisconsin. Like many of you, I wonder which direction we are headed long term, but for now I have just been playing what the chart gives me. Just a recap on some of my memorable swings before I went on hiatus: $WTRH was an amazing play that I couldn’t believe the price action. I’ll admit that I was pretty skeptical about the contact free delivery model as noted in 3/9 – 3/13 watch list, however, it worked out perfectly. Nevertheless, I was swinging for a different reason namely the Billionaire backed investor, but we ended in the same place which was a profitable investment so congrats if you took a position.

As for the swing watch list, I want to at least put out a few tickers that I have been monitoring. Keep in mind that I have reverted to mainly a scalp strategy and if I do swing it has been just an overnighter during these times. Please use caution as anything can happen!

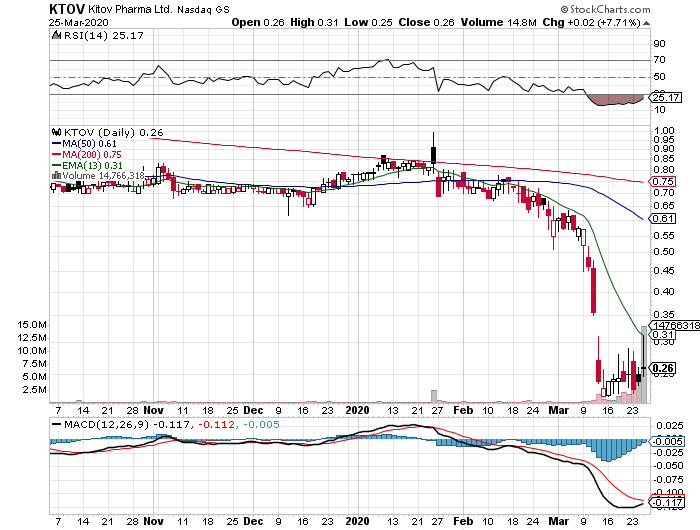

$KTOV – a ticker that was brought to my attention on twitter that frankly I just like the daily chart set up. Currently hovering just below the 13ema on the daily chart so ideally looking for a strong break over that for a price target of .53 (50ema, daily). Not very concerned about further dilution as they recently had an offering so keep it on the back burner for now.

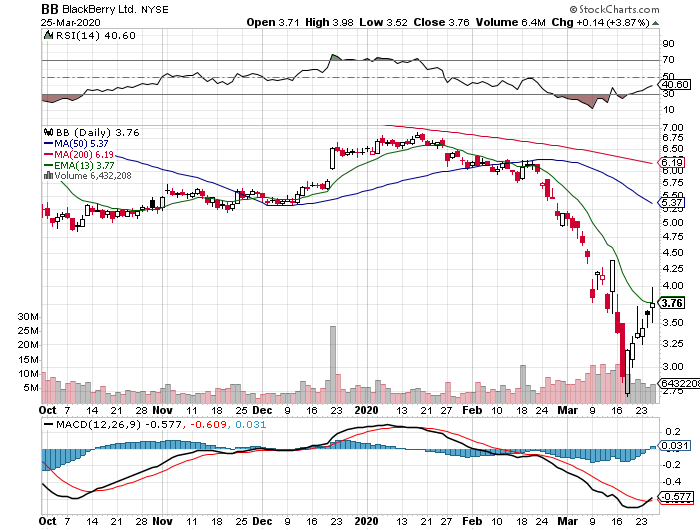

$BB – Talked about this old tech giant in the past and keep in mind this is more of an IRA play despite what I said about scalping. At these prices it is definitely worth taking a starter as they seem to be making advancements in the autonomous vehicle space. Currently right at the 13ema, daily and I am fairly confident we could see $4+ this week.

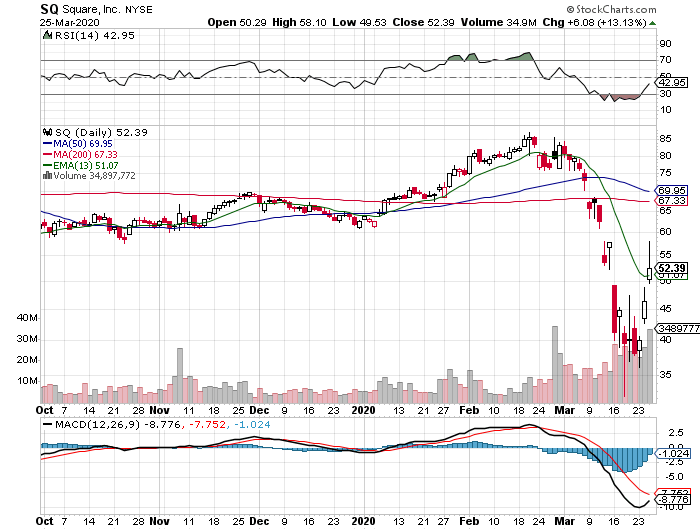

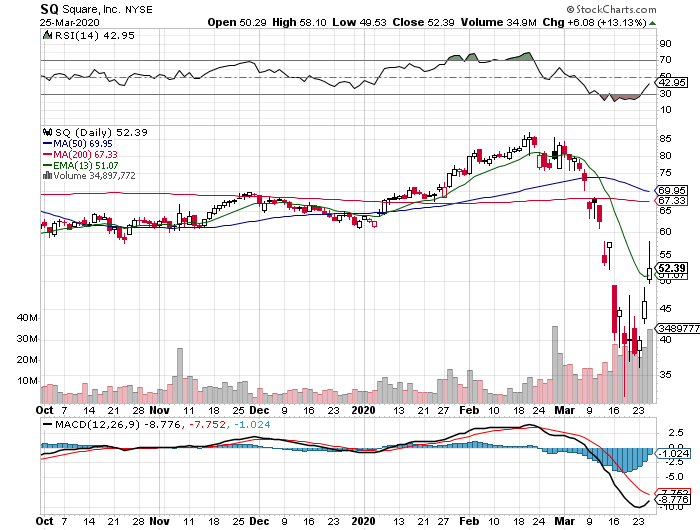

$SQ – If you follow me on twitter (@Txjustice3) you’ll know this was my money maker this week. Honestly, I was second guessing myself with how volatile it played, but worked out ok so far. I did take some off today and have a few “FU shares” that I might add to if it gets back into the high 30’s again. I would wait for this one to come down a bit before taking a bounce play since it follows the $SPY pretty consistently. (See notes on $SPY)

$SPY – It’s like I went back in time to AstroWorld (Houstonians will get the reference) because this was/is a rollercoaster! Played both puts and calls and paid a nice premium for both. Won some, lost some what can I say I am not perfect. I kinda miss the beginning of the year when weekly options were dirty cheap and I never lost! Anyways, here is my assessment, but take it with a grain of salt. We had a nice rally the past two days; however we failed to have a solid break over the $253. With the dirty politics going on in congress, I don’t think there will be the strong bullish sentiment many traders and investors are looking for. For the rest of the week leading into next week I am bearish. I just have to trade the chart and I am not too thrilled about watching the markets take a deep dive due to the CCP Virus, but I do think this was the straw that broke the camel’s back since we were due for a correction. I just didn’t think it would lead to an all out recession. Of course it will get a little worse before things start to get better and make no mistake Q2 and possible Q3 numbers will take a catastrophic hit. I do think this will not be a shock to investors as this will probably be “baked in” at this point. For this assessment I really hope I am wrong!

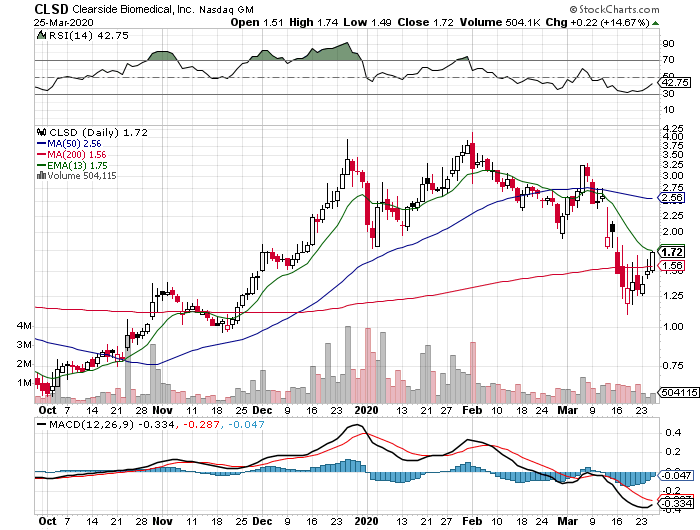

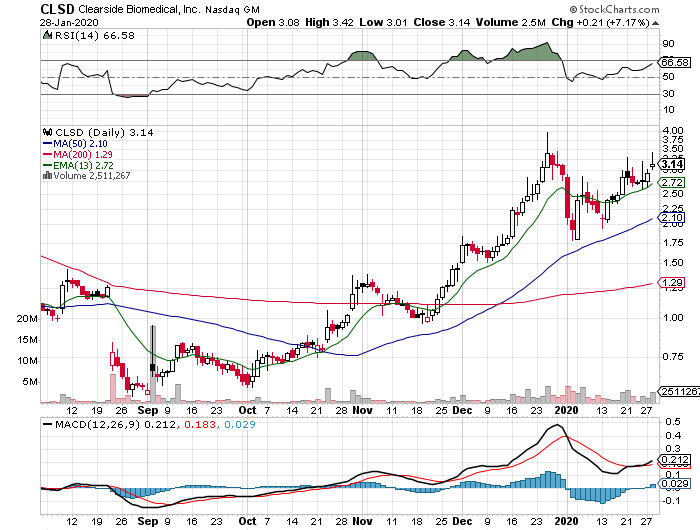

$CLSD – Keep this former turd on the back burner as you can probably get a decent scalp out of if once it breaks 1.75. Looking for a conservative 2.10 PT.

3/9 – 3-13/2020 Weekly Watch List:

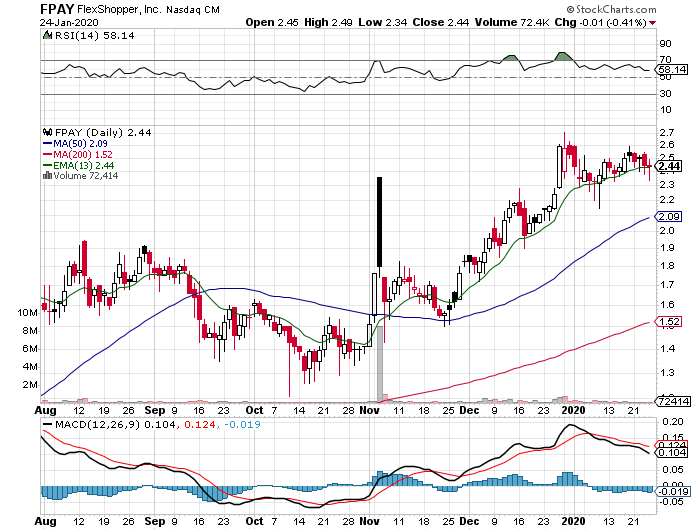

Well this week was a pretty tricky and frustrating week for me to say the least. I seemed to have been off my game with swing plays and even some scalps. This corona virus situation is getting a bit out of control and clearly has taken a toll on the market. Hopefully we can see a turnaround in the near future as I personally don’t think it will last much longer since we are in the tail end of the winter season. I am obviously not a doctor or a medical expert so take this with a grain of salt haha. Had a few great fundamental plays that really frustrated me this week, but I am still holding strong on some and had to unfortunately bail on others. I am still holding my FPAY swing where I was able to take off a few share Monday in after hours when the ER was released. I was actually surprised with the drastic drop the next day, but I knew this ticker traded choppy so ended up averaging down a bit on Friday. I can’t predict the future, but hopefully we start to trend back up this coming week. It seemed like nothing I was in was able to hold very well this week which happens from time to time. I guess it is just part of the game and one has to take the good with the bad in their own trading journey. Anyways, here are a few tickers that I will be monitoring next week:

$SLRX – Nothing super special here except I like the gap to fill play on the daily chart. I will monitor more closely once it crosses over the 13ema on the daily chart (.99) since there is a decent amount of room to run with the 50ma at 2.25 and 200ma at 6.60. I like the total cash (4mil) and relatively manageable debt (749.16k). The company recently closed an $11 million offering so they should have enough cash on hand to last at least a few more quarters so minimal risk of another offering dropping. I haven’t seen anything yet from the company on when their Q4 ER will be out, but I suspect they will announce sometime within the next two weeks.

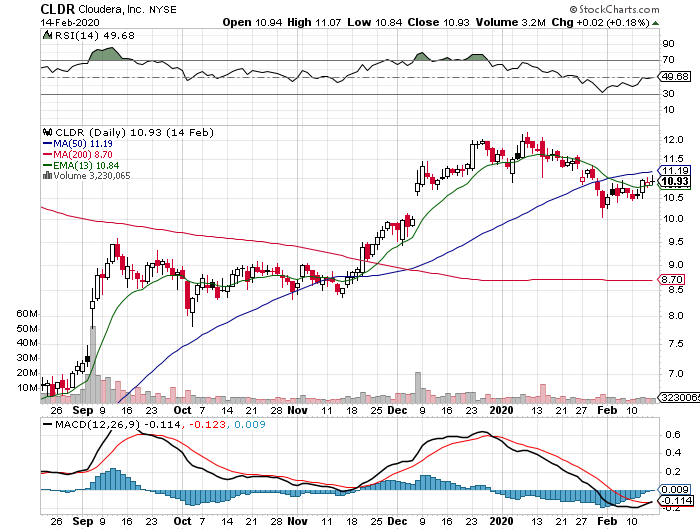

$CLDR – This was probably one of my most profitable IRA swings in the past and it caught my attention for a possible mid-length swing again. I am pretty sure many of you already know Carl Icahn is heavily invested in this company so I won’t bore you with the details. I personally think the tumble on the S&P 500 has allowed for a lot of higher priced tickers to go on sale. I will be monitoring this one next week for signs of a bounce back over the 200ma (8.62). However, if more downside action continues next week then just keep it as a back burner watch. Last Friday did show a small uptrend in power hour so I am fairly optimistic this will reclaim the 200ma.

$NTGN – Decent daily chart where it has held above the 13ema. Keeping this one as a back burner watch, but will start a position if it can break over Friday’s HOD (1.86). The next small resistance I see is 1.98-2.00, but after than nice room to run to the 200ma (2.48). Keep on watch. Total Cash: 29.39M; Total Debt: 7.78M

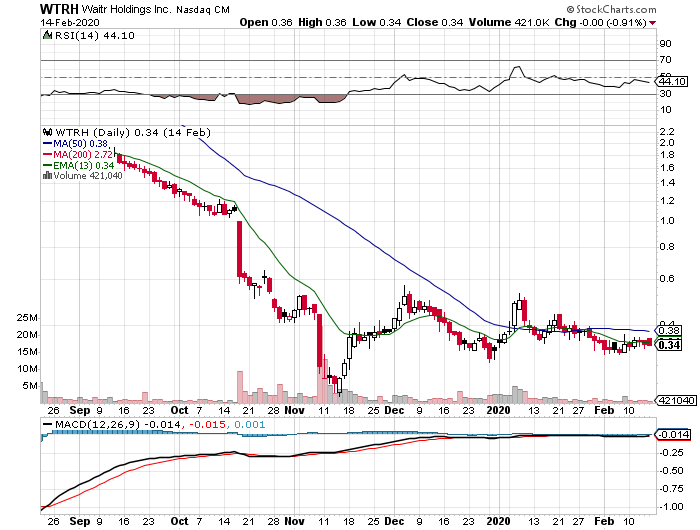

$WTRH – I have a position here, but did take off a few at .46 on Friday just to lock in some profits. Still holding my core position and while I can’t say I am thrilled that it didn’t hold above .42 at least we closed at .40. On the daily chart, we are finally starting to uptrend so I am optimistic of an eventual .50 touch. .57 is the real test on whether this will have a true breakout so I am taking my chances with a mid term swing on this one. The risk vs. reward is something I just cant really ignore at this point. I do believe this is a beaten down ticker, but I don’t agree with a lot of the Stocktwits chatter about this being a Coronavirus play due to people staying at home and ordering. If life gets that severe I highly doubt that drivers would be willing to sacrifice their health for a few bucks. It also sets them up for more exposure since they will be going to several residence where the customer’s health status is unknown. One person noted that the driver could just drop off the food at the door which is an alternative, but then that leads to the question of who prepared the food? What is their health status? If CV gets that bad I don’t see food delivery services drivers sticking their neck out. Just my opinion on that matter, but again I do agree this is due for an uptrend.

$GE – From last week’s list that I will continue to monitor for some sign of a turn around. More than likely I will just pick up some call options a few weeks out. I do think the new CEO is doing a much better job of cleaning up the corrupt and sleazy mess from the past two CEOs, but of course it will be a slow process. Only time will tell though if this American Institution can rise out of the ashes.

$BB – Also played this one in the past with a lot of success. Yes, many are shocked when they see the Blackberry name and associate it with the dominant phone before the iPhone came along. However, I am interested in their Autonomous Vehicle tech and with the markets in “turmoil” according to the ever so “credible” MSNBC, I think this is at a slight discount. I will be watching throughout the next few weeks and again I might play a few call contracts if there are any signs of a reversal.

3/2 – 3/6/2020 Weekly Watch List:

$OGEN – This was from last week’s watch list, but Friday started to show life so I took a position in anticipation for more upside this coming week. After hours showed relatively great strength even breaking over .84 resistance and held. IF .84 can hold, then 1.09 is the next resistance area; however, I really think that we will most likely see a $1 breakout this week with a decent volume surge. I know several people have already messaged me on twitter that took a position with me at .63 so for those in early we have some cushion to withstand the small dips.

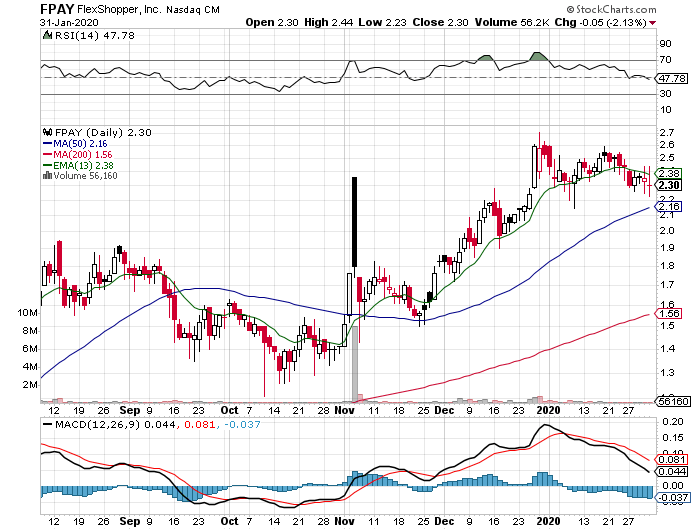

$FPAY – A familiar ticker that I like to play if you have followed this blog for a while. The Earning’s Report is going to be posted tomorrow in after hours in which I am fairly confident they will beat expectations again. This is a ticker that just likes to trade slow and steady as well as quarter over quarter revenue growth, increased guidance every quarter, as well as huge and steady insider buys. Not to mention this is the new CEO’s first full quarter so it will be interesting to hear his vision for the next leg of Flexshopper’s journey. Just like last ER, I am anticipating a run up tomorrow (Monday) at least back over $3. It has been steadily trending above the 50ema on the daily chart pretty well so keep this one on high watch for tomorrow. Short term PT: 3.5, but if you have the patience I can see this conservatively reaching over $4 this week.

$ADXS – Just on watch for now since it closed right above the 100ma on Friday. I am monitoring it to see if we can get a bounce here for a quick scalp, but if it falls under then it is a “no-go” for me.

$APRN – Another one that is just a watch for now, but I do like this company and know several people who use the service to cook meals at home. Not to mention they are major sponsors of several well known podcasts so there might be some gas left in the tank on this one. On the daily chart, it looks like it wants a 13ema break, but I am optimistically cautious as the last time it attempted a 13ema break over it failed. IF we can get a solid break over 3.13 (13ema, daily) then there is room to run to the 4.59 (50ema).

$SBPH – Honestly I just like the chart on this one. Currently above the 13ema (daily), gap to fill play, relatively lowish RSI, and room to run to the 50ma. So could present itself with a good scalp opportunity. Keep on watch for the week for volume to move in.

$GE – Classic American Company that had a very noticeable bounce off the 200ma so watching throughout the week for a possible turn around.

2/24 – 2/28/2020 Weekly Watch List:

Sorry for the later than normal weekly watch list as I decided to spend the day driving around Lake Travis admiring the extravagant houses and just feeling the benefits of what opportunities this state and country have to offer if you really commit to your dreams. All while the number one American “Socialist” was in town today so decided to stay clear away from Downtown. Anyways, here is what I am watching for the week as well as keeping an eye on last weeks list that quite develop.

$WTRH – Still on the list from previous posts as we are slowly and steadily rising. I was actually impressed we were able to break back in the .40s last week so this week I really want to see more progress with the break over .42 (50ema). Like I mentioned previously, this one is relatively off the radar so once it gets more momentum we can steadily inch our way back towards 1.00.

$OGEN – I couldn’t help but to keep this one high watch as the daily chart is just screaming “U-shape.” Also, the gap to fill setup on the daily chart is my bread and butter play that I tend to gravitate towards so that is another plus. I would not be surprised to see news drop this week that allows us to break over crucial .84 gap to fill territory and possibly even 1.00. Of course, anything can happen, positive or negative, but keep this on your hawk eye watch list for the week.

$GHSI – More of a speculative play for now; however, I do like the chart setup for a possible uptrend this week. Honestly, I plan on just scalping this one, IF we can get a solid break over .32 (100ma) which could give it the MOMO needed for a .50PT.

$CBAY – Gap to fill play with a possible 13ema and 50ma squeeze forming on the daily chart. Nice room to run IF MOMO comes in. I have had this one on my back burner for a while, but it looks like the uptrend back to 2.00 is progressing. Not really a “focus intently” ticker, but definitely one to watch.

2/18 – 2/21/2020 Weekly Watch List:

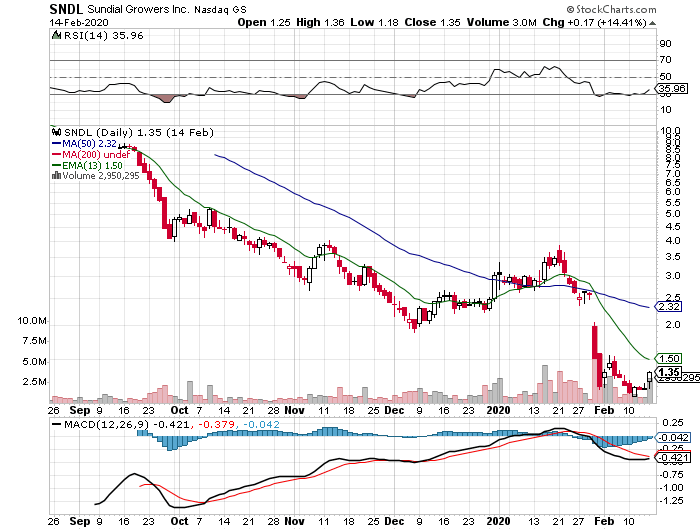

$SNDL – Not gonna lie, pretty stupid name, but the daily chart presents itself with a good setup. Gap to fill play that appears to be curling back up. Ideally, I want to see a break over 1.5 (13ema, daily) for a shot at a 2.00 price target. However, I have a feeling that we will see a bit more consolidation unless positive news drops. Keep this one on your back burner.

$SEEL – No not the one hit wonder singer from the 90’s, but we did see great slow and steady action last Friday. This one got upgraded to my favorites list as it is just about to cross over .95 (13ema, daily). This is right about the time in the chart that companies like to drop press releases to get their tickers moving so I wouldn’t be surprised to see $SEEL’s management do the same. Some concerning factors I must discuss is that if you review the daily chart this ticker has a lot of spikes, but doesn’t hold gains well. On the other hand there are quite a lot of frequent spikes so that is a positive for quick scalps. Lets see what the week will bring for Seelos Therapeutics, Inc.

$CLDR – I love this ticker!!! So many positives like Carl Ichan’s huge stake, innovative AI cloud computing, and a management team that has learned from past rookie mistakes and getting better. Full disclosure I have a stake already in my IRA that I play to hold for a while, but with their earnings report coming up in March I have considering playing call options in my taxable account as well. Icahn was able to get two board seats so I presume that his team’s experience will help to navigate Cloudera’s management team on the right path. This is most definitely a longer term swing, but I am looking for over 11.20 (50ma, daily).

$WTRH – Mentioned this ticker previously for which I have taken a position and also added last Friday. With earnings estimated to drop in the beginning of March I am looking for a little pre-ER run up soon. I highly suspect that the company is prepping to sell, but of course this is just speculation. They recently announced they are switching from the W-2 structure to a 1099 contract worker status thus aligning itself with the other food delivery services. Possibly for an easy transition, but like I said just speculation at this point. What I do like about the chart is we closed above the 13ema. I want at least a test of the 50ma this week and then a shot back in the .40’s.

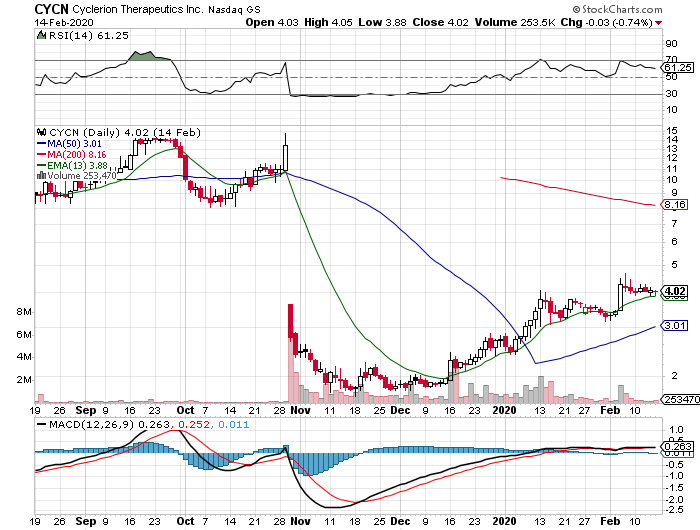

$CYCN – Just on watch for the possible bounce off 3.88 (13ema, daily). IF we can achieve that, I want to take a small position for a conservative 4.50 price target.

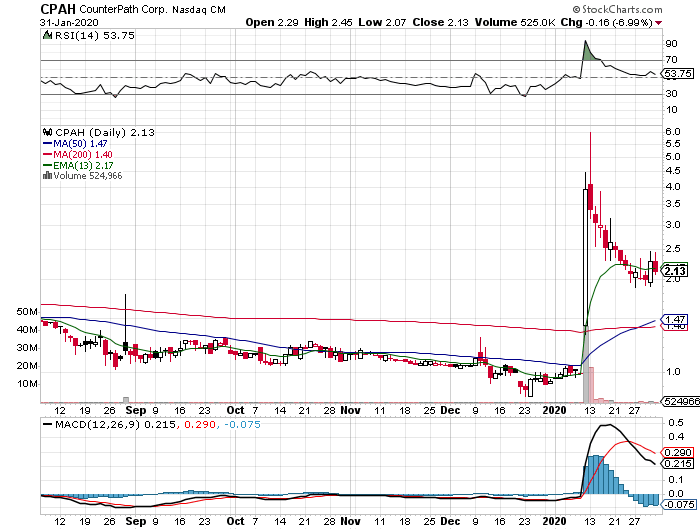

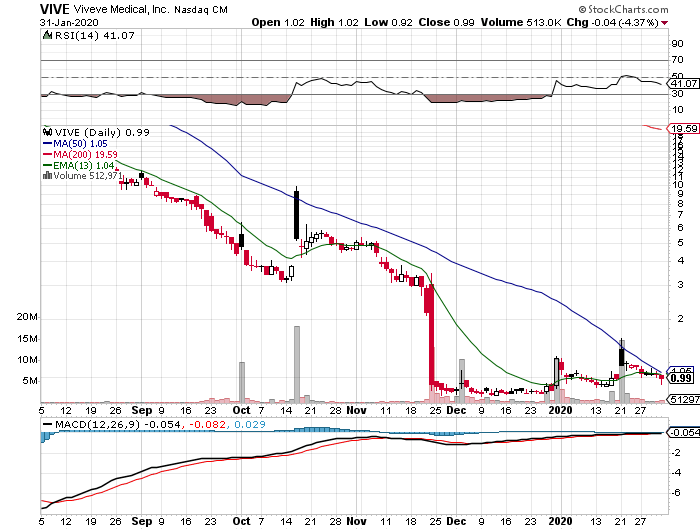

2/13/2020 Thursday Recap: What a day! Our CPAH swing worked out way better than I expected! I even tweeted out from my account (@txjustice3) that I wanted to see at 2.3 break today and then BAM news drops sending the ticker to a high of 3.48! Congrats to those that stuck with it as it consolidated very well. I also started to tweet out more live alerts for those that appreciate the occasional day trade. LLIT was the quick scalp which was alerted before the $1.00 break and ending with a high of 1.19. Not exactly my favorite setup, but these dollar breaks lead to decent scalps most of the time. As for VBIV I am still in since it stayed around the 1.60 mark, but this one is kinda testing my patience; however, I am giving it a little time to develop. I am still looking for the eventual break over 1.70 and have my mental stop loss around 1.55 so we shall see what happens. VIVE what can I say? If this isn’t a sign to be more patient I don’t know what is? This was an earlier alert from the weekly watchlist, but of course I bail out and then a huge 13g drops today! Unfortunately, trading is hard and I will miss plays and second doubt myself; however, the silver lining is that I was right on the alert just a day late and a dollar short. Just like a skilled surfer knows, there will be other waves.

Back Burner Watch List:

TTOO – Nice little slow and steady uptrend today that also closed above the 13ema on the daily chart. Not exactly a dollar breakout criteria, but does present a decent scalp opportunity once over a dollar. Small resistance at 1.09 and after that then room to run to 1.72 (200ma).

CFRX – Recent reverse split that seemed to get a little traction today. Closed above the 13ema on the daily chart so I’ll just keep this on the sidelines to see how it will trade over the trading days. Ideally I would like to see a solid break over 8.75 and a move towards 10.00. For now just watch this one unless substantial news comes out.

SPY – What a crazy ride!!!! Honestly, I am getting a little weary of the constant all time highs (not that I don’t like it) but how much further can we go without a pullback? Today signaled the first actual red candle on the daily chart so it will be interesting to see if bulls can overpower the bears again or if we now see a correction possibly down towards 330. I have been playing both weekly puts and calls as well as profiting and getting wrecked hahaha. As of now, I am slightly bearish, but do not think there will be the massive doom and gloom crash that some are predicting. I sincerely hope I am wrong, but in the meantime just trade the chart and drowned out the noise. Follow your own plan.

2/11/2020 Tuesday Recap: Well so far has been an “eh” start to the week for me. If you follow me on twitter @txjustice3 I gave a live day trading alert on FCEL and managed to scalp it. However, I didn’t like much the rest of the day on Monday. DGLY from our swing list did hover around the 1.00 area before getting a small pop, but then just faded the whole day so I will not be counting this as a successful alert. I did take a starter position on it, but was not liking the action so just bailed. I am still in my VBIV swing and honestly if we can’t break over 1.60 tomorrow I will most likely bail on that one as well since it has been pretty stagnant. I am very particular about my trading strategy and I don’t like to hold on “maybe” swings when I could put those funds to better use in a swing alert with a higher probability of success. Do I get it wrong sometimes? Of course I am human! With that being said I am very pleased with my calls lately as I have been able to take the meat of the move on my runners and have kicked weaker swings to the curb for either a small profit or a small loss. A great trader’s goal is to not predict the tops and bottoms of plays, but to have a heightened sense of risk vs reward probability and to have more winners than losers.

I don’t have much in terms of a watch list tonight since I have been extremely busy. I am definitely keeping WTRH on high watch after two 13g filings so something might be brewing. I have also been playing weekly options on the SPY both calls and puts. Just like most of you, I am anxious to see which way the general market wants to move. I will say as of this week, I have been on the bearish side, but we’ll see how the rest of the week trades.

2/10 – 2/14/2020 Weekly Watch List:

SRNE – I’ve had this one on my back burner list for some time waiting for a decent entry point. This chart is a little shaky so I will not sugar coat it and act like it is going to straight up explode this week! Nevertheless, the possible bounce off/near the 200ma (2.80) on the daily chart looks interesting. IF, it can manage to bounce and consolidate, I see a shot at a conservative price target of 3.50 – .70. For now, I would keep this one on the backburner and set alerts just above the 200ma as a reminder to keep on high watch. Current price: 2.97; Float: 98.15M.

DGLY – Huge spike on 2/4 topping out with a high of 2.02 and then dropped to consolidate around the 100ma (1.16). Keeping this one on watch this week for a quick scalping opportunity if momentum comes back in. If not, then look for the possible bounce off of $1 support. Current price: 1.19; Float: 6.68M.

MARA – I am not a fan of this ticker; however, with Bitcoin now over 10k I guess this will also bring in some scalp opportunities. Be extremely careful with this one as it gets pumped and dumped fast. Keeping this one on the backburner just in case and IF momentum comes in look for .10-.15/shares scalps. Current price: 1.17; Float: 7.57M

VIVE – Still watching this one from last week. My ideal game plan is for this ticker to break over and close above the 13ema on the daily chart (1.02). After this occurs I want to see a slow and steady uptrend to 1.25+. The RSI is relatively low (48.08) and one can see that this ticker has some decent one day spikes. Current price: .98; Float: 1.39M

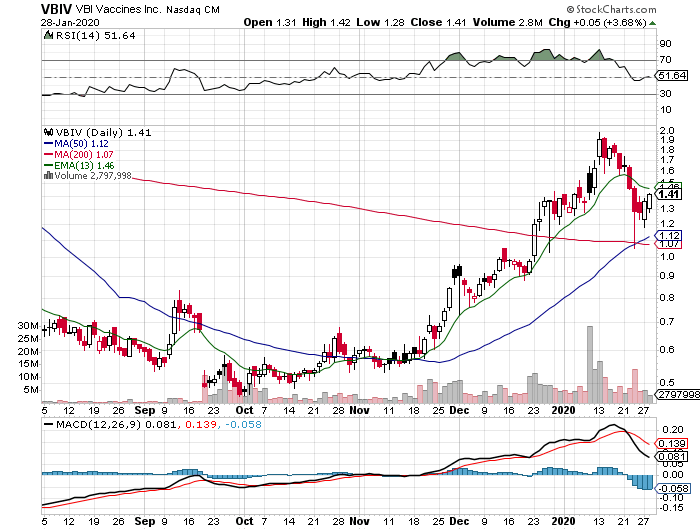

VBIV – This is one that I am keeping on high watch for the rest of the week. More than likely I will be starting a position between 1.45 – 1.60. For those of you who have followed this blog since its inception, you would know that I had this one on watch for some time now. I am fairly confident that the Cup and Handle pattern on the daily chart will hold up and we will eventually see the 1.70 break. If 1.70 can break and hold, then the next major resistance will be $2. These are some of my favorite plays because they usually trade slow and steady. Current price: 1.48; Float: 107.11M.

CPAH – I still have my starter on this one, but haven’t added any yet. The 2.00 area held up pretty well as support as noted in last week’s swing blog. I am looking for another leg up over 2.3 to add more since there is so much potential on the daily chart. For now, I am putting my price target at 3.00. Current price: 2.28; Float: 3.03M

WTRH – I mentioned this one last week during one of my recaps and Friday’s action was very telling. There was a decent volume surge Friday morning and managed to consolidate well throughout the day. I went ahead and started a 10k share position at .34 since I like several factors about this play: 1. I think it is highly undervalued given the food delivery space arena and how they stand out by targeting small and mid sized cities since competition with Grubhub and Uber are saturated in the bigger cities. 2. I do like that Tillman Fertitta is on the board as he a one of the world’s leading restaurateurs and the owner of the Houston Rockets. I kinda like it that he is underwater at the moment with his position as this tends to get a fire set with management when a powerful investor is on board. 3. From a technical standpoint, the RSI is signaling oversold so I took a position in anticipation of the 13ema (.35) crossover. Once that happens, .39 will be the next major resistance area. I am not going to lie to you, this ticker will have a lot of resistance along the way so unless there is some drastic news, good or bad, this will be a longer swing so keep that in mind. 1st price target: .50. Current price: .34; Float: 56.43M

2/5/2020 Wednesday Recap:

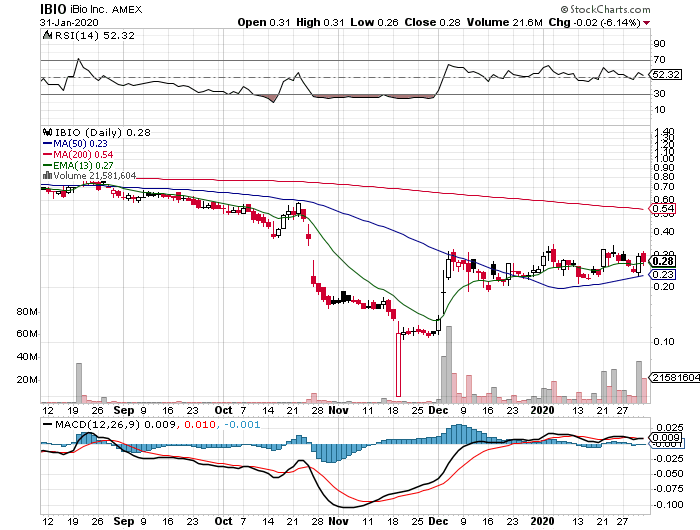

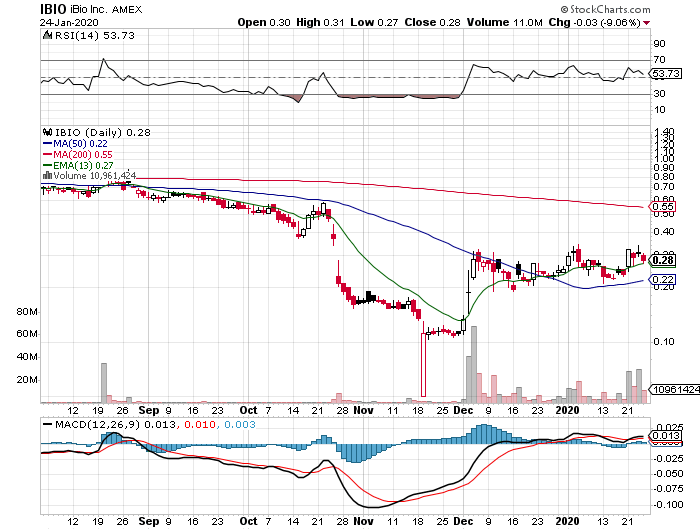

Talk about a great week! So far we have had two (2) definite runners from the watch list and there is still a lot of gas left in the tank. $IBIO and $FPAY have done exceptionally well, although I conservatively took profits on $IBIO. If you are still monitoring this ticker, after hours today got another little ramp up so keep on watch tomorrow (Thursday) for a retest/breakout over .50c.

Now lets focus our attention on $FPAY, I am still long and strong on this one as I mentioned before the fundamentals are so sexy! Quarter over quarter revenue growth and increases just makes any swing trader/investor salivate! On top of all that, we actually hit a new 52 week high today and consolidated near the critical 2.70 breakout. This is very critical because typically companies will put out significant press releases near breakout areas so I wouldn’t be surprised to see something from Flexshopper this week, but of course it is hard to predict the future. However, the same game plan applies from Sunday, we need a solid volume breakout for a $3 touch. Once that occurs and depending on MOMO, I am putting my PT at $4. I have analyzed this company from head to toe even going as far as asking complex financial questions to investor relations, which he was quiet candid and honest by the way, and I have to say I am a fan of the business model. With that being said NEVER fall in love with any ticker! This is the stock market and retail traders are the bottom of the barrel when it comes to investing. We don’t seek out the cake we just try and scour for crumbs, but if you can accumulate enough crumbs then eventually you can have enough for a cake! Sorry that sounded better in my head and I am kinda freestyling this right now lol. Essentially always have a game plan for when shit hits the fan and for when you are on your way to becoming the richest man (or woman) in Babylon.

For the sake of being honest, I did have one ticker on my watch list that didn’t reach its full potential and that was $ELGX. I had slightly higher hopes for this one but in the words of of Junior Soprano “It didn’t have the makings of a varsity player.” ( I hope at least some of you got the referrence). I took a starter on the daily chart yesterday as it looked like we would potentially have a reversal from that green candle, but as you can see there wasn’t the follow through and ended up bailing for a small loss. Unfortunately that is the nature of this game, but if you are able to have bigger wins than losses in theory you should be progressing even though it doesn’t feel like it sometimes. In this game it is always 2 steps forward and 1 step back, but if you keep at it eventually you will get to your desired destination.

Other than the weekly watch list I don’t really have any new tickers for the remainder of the week. On top of trading my watch list, I will be playing $SPY options, both calls and puts and following any blue chip tickers with upcoming earnings. I don’t usually hold through earnings unless I have done extensive financial research so typically I will play earnings run ups and volatility after the ER. Starting next week I will post some of my weekly options watch list picks for those that follow.

What kind of material do you want to see in future blogs? Please email me with suggestions, praise, even tell me what you don’t like, or just let me know your own personal victories and struggles in the market (disclaimer: I am not your therapist so keep it stock related). Email: txjustice2020@gmail.com and/or Twiter: @txjustice3

2/3/2020 Mondy Recap:

Well…Well…Well (Insert Mic Drop Gif Here). $IBIO what a sneaky little guy! I was starting to doubt myself there all day as we literally did nothing! However, I have been in this game long enough that you have to ignore the noise and stick to your trading plan! You can check every $IBIO blog post since first alerting last week, this executed to the tee! Just yesterday while writing up this blog I reaffirmed my confidence with this ticker and mapped out exactly what I wanted to happen. I’ll admit I had a bit of a rocky last week so when $IBIO wasn’t showing any promise throughout the day I was contemplating on selling at my entry. During these times I like to take a step back and go over all my research before deciding to do something like that. I re-evaluated past CEO statements, scanned SEC filings, and even skimmed over what other traders I follow were saying. The reasons why I decided to hold on to the swing were: A.) I knew they were not directly related to the Corona Virus, but they were designed to quickly and efficiently be ready to mass produce vaccines in conjunction with other collaborators. B.) It is the penny stock world so any beaten down biotech is trying to loosely put out PRs with any mention of the virus, especially now that we have found out that China has been fudging the numbers (Big Shocker!!!). C.) The dumbest reason, but I went with it is this company is affiliated with Texas A&M which happens to be where I went for undergrad. Whatever the reasons, legit or idiotic, it worked out. I had a total of 8k shares at .28 average. I sold 5k shares once I saw the news pop up and will be swinging the rest for tomorrow. I moved my stop loss up to .35 for the remainder of my shares which is right below the current VWAP on the 5 min chart so we’ll see what happens. I just want to be honest and open about my swing positions as it is easy to get caught up in the hype and hysteria of the the stock market. This takes practice, perseverance, dedication, hard work, and a little bit of luck. I don’t go all out balls to the wall position sizes like some traders as it is not my style. However, I am able to consistently make anywhere from $1 – 5k a week swinging, scalping, and now playing calls and puts. Yes, there are way better traders out there and yes, you should definitely learn from a multitude of sources. So if your are reading this and still haven’t been able to consistently make profit then I really want you to understand that this takes time. Review trades that you might have missed or have taken a loss on to look back and learn from it. Quite frankly, I often scrutinize my losers with a fine tooth comb to see what I did wrong. Was I too emotional at the time of the trade? Did I not stick to my plan?

Not really a lot on the table as far as tickers today for me as I was extremely busy with other side projects, but I did a little more research on a particular ticker that I have been following. I’m not sure if many of you are aware, but I am from Texas. So naturally Texans like to focus on Texas businesses from Dr. Pepper/Snapple to little unknown penny stocks. One that I have been intrigued with in $WTRH which is a food delivery service much like Grubhub, DoorDash, and UberEats. However, this ticker is very different due to an individual that has a huge stake and sits on the BOD. Tillman Fertitta, World’s largest restauranteur and owner of the Houston Rockets has an enormous stake in this which is what first caught my attention. The financials on the other hand are a different story with the word lackluster coming to mind. Also, this company has had a lot of management changes recently, most notably the ousting of Adam Price in favor of Carl Grimstad. This is still in the very speculative stages, but keep this on a back burner list as I suspect the company is gearing up to sell. One reason of this conviction is that Waitr, unlike their competitors, operated on a W-2 system where their competitor’s drivers are self employed contractors (1099). Just today news came out that Waitr will switch to a 1099 system which I suspect will help them to seamlessly integrate into whoever decides to buy them out. Again this is very speculative at this point so just keep on watch for now. I will still be monitoring the rest of my weekly watch list. Who knows maybe I can knock it out of the park this week and have every idea run.

2/3 – 2/7/2020

Trading Ideas:

$ELGX – I am only watching this for a possible bounce near the $1 mark. Friday showed a significant dumping of shares without any news to substantiate the sell off. IF $1 can hold as support, I think this will attract a lot of attention from scalpers and day traders this week for a potential dead cat bounce. After hours Friday showed a close of 1.10 so I will have this on moderate watch Monday morning to monitor the price action. However, if $1 cannot hold as support I wouldn’t bother. As of now, my plan of action is to shoot for .10-.30/share scalp. I am not really onboard with the financials of the company with their fairly large debt, but the book value does look appealing. Float: 13.14M; % Held by Institutions: 86.86%; Total Cash: 46.59M; Total Debt: 190.33M; Book Value per Share: 3.90

$CPAH – Swing alert from last week that held up the $2 support and slowly trended back up reaching a high of 2.46 last Friday. I still have a starter position and will add if we can successfully break over 2.50 and hold. If we can slowly and steadily curl back up making higher lows next week, it is not out of the question to see a conservative price target of $3. However, while researching there were a few things of concern to keep in mind. On 12/19/2019, NASDAQ notified the company the the stockholders’ equity of $1,922,675 ans reported the Quarterly Report was below the minimum stockholders’ equity of $2.5M. They were given until Jan 30th the provide a plan to regain minimum equity. So I would assume we will hear something of the matter this week. Usually these letters are not a big deal but there is still a chance of negative price action depending on news. Another issue I see is their cash to debt ratio is not ideal. Float: 3.03M; Total Cash: 1.85M; Total Debt: 5.58M

$IBIO – Another swing alert from last week that I decided to take a position. I have stated previously that I don’t typically like to swing tickers under .50c, but of course this is the market and there is an exception to every rule. This ticker has a lot of hype on social media which is not necessarily a bad thing, but one has to stay on their toes to bail out if the plan doesn’t go accordingly. With that being said, I have seen pretty big moves based on hype so anything can happen. From a technical standpoint, $IBIO needs to break over .32 – .34 area for a shot at .50c. Many traders are associating this ticker with the Corona Virus, but that is not entirely true as iBio, Inc. is a “biotechnology company, providing product development and manufacturing services to clients, collaborators, and third party customers in the United States.” Meaning, they provide the manufacturing capabilities to mass produce vaccines IF another company were to develop a cure and collaborated with iBio. More than likely this will get pumped with the Corona Virus hysteria where the company will also more than likely drop an offering since they are cash strapped with massive debt. Nevertheless, this ticker presents itself with good scalping opportunities. Float: 23.63M; Total Cash: 2.1M; Total Debt: 32.37M

$VIVE – I stumbled upon this ticker while doing my Sunday watch list where I specifically try and find beaten down tickers. $VIVE held a base support in the .80s after gaping down from the $3s. Since the start of the year I have noticed increased volume with some decent volume and spikes in January. I am really interested in the 13ema and 50ma squeeze presenting itself on the the daily chart. Watch for the break over 1.05 (50ma, daily) for more MOMO to pour in. This is another ticker that I would only be comfortable taking scalps over a confident swing as I am not a huge fan of the cash to debt ratio. Float: 1.39M; Total Cash: 9.09M; Total Debt: 32.15M.

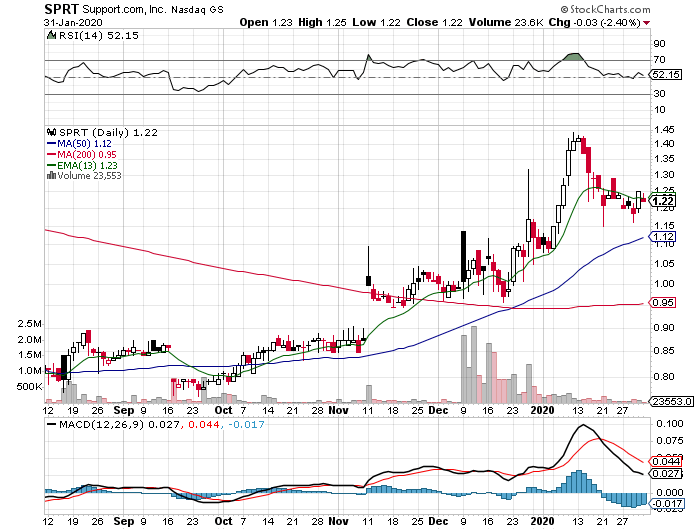

$SPRT – Honestly, this chart looks interesting since the gap down and has been trailing just below the 13ema on the daily chart. I suspect once this breaks over and gets on trader’s scanners we could see MOMO bring this to at least 1.50. I will be keeping this one on watch throughout the week to see how it trades. Not to mention that this company is trading below cash with awesome cash on hand. It is pretty rare to see a penny stock that actually minds its balance sheet. Float: 13.09M; Total Cash: 44.75M; Total Debt: 113k; Book Value per Share: 2.73

$FPAY – Speaking of another company that has a great balance sheet and is profitable to add, this company has done extremely well for me in the past. Since the end of December 2019, this ticker has traded in an extremely slow rough channel from 2.28 to 2.7. Last week we saw not so favorable price action, but Friday’s daily candle closed on a doji which typically indicates a reversal. This company, while extremely slow, is reliable with quarter over quarter revenue increase and just became profitable last year. Not to mention a positive EBITDA. Also, new CEO with a wealth of experience to move this company to the next level. I do suspect the plea to warrant holders to exercise their shares with an incentive is because cash is running a little low, but with several lines of credit the company has I don’t think this will be a big problem like it would for a typical penny ticker. Float: 9.37; Total Cash: 3.17M; Total Debt: 27.05M.

Let’s see what this week holds for us! No matter what happens have a plan and stick with it. Great traders understand that it is not about predicting tops and bottoms, but choosing the best risk vs. reward plays that fit within YOUR trading criteria.

Date 1/30/2020

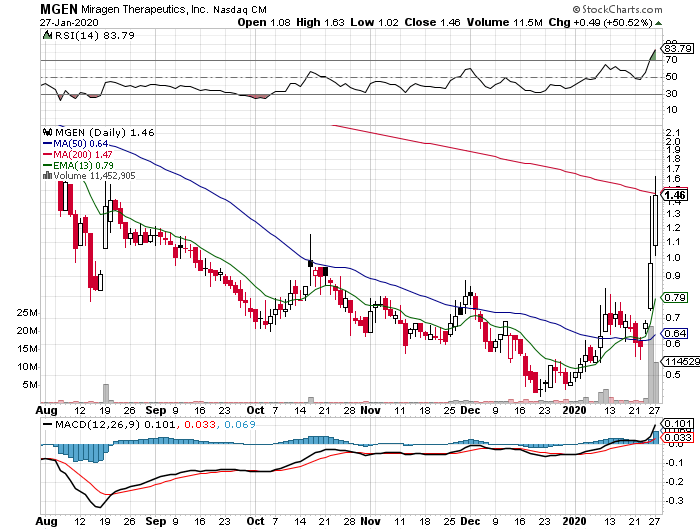

Thursday Recap: Wow it has been a pretty hectic week for me with projects and managing trades, but glad to be back writing and sharing ideas with everyone. What can I say about $MGEN except we nailed that play! Unfortunately, as mentioned previously, I did take profit earlier in the week, however, if you stuck around and had the cojones then congratulations because you absolutely killed it. Remember it is not the quantity of trades that you take that will help to grow your account, it is quality setups before the crowd that will keep you in this game. I had to scale down a little on my $FCEL swing yesterday since I wasn’t getting the momentum I wanted after the pre-market spike. Ideally, I want to re-add to my swing position if we can push back into the 1.80’s and have a solid break over 1.90 (13ema, daily chart). I still like this play and will continue to monitor it. $PULM had a nice little spike in pre-market this morning, but then slowly faded all day. I’ll admit I held on longer than I should as I thought we would rebound after coming down to 1.88 support. I guess that is the nature of the game sometimes and have to have a price target set and be ready to take it. I did get into a starter swing today when my $IBIO alerts went off on TC2000. As alerted on 1/26/2020 swing list, I had this one on watch to see how it would trade. Honestly, I wasn’t too impressed with the pullback since alerting it, but just set alerts for .28 to come back and watch it. Today’s volume was interesting and there was a lot of chatter around this ticker so started a swing position in the IRA. As I write this blog, looks like it hit a high in after hours of .31. If we can get past the 100ma (.32) tomorrow I might add a few thousand shares to the swing in anticipation for a run to .50. We’ll see how tomorrow plays out, but just in case this one doesn’t pan out I’ll most like have a mental stop loss around .26 or .27.

Penny Watch List:

$IBIO – As noted in the recap, I took a starter position and plan on adding over .32 depending on how momentum plays out tomorrow. There is a lot of buzz on this ticker so be prepared for anything. Ideally, I would like a slow and steady move up tomorrow and maybe even touch in the .40s. Ultimate price target is .50.

$ADXS – Still in the running with me so far. I have a small 5k share position at .88 that I started today. The trick that works for me when deciding a starter position is to make a watch list and then monitor the price action for a day or two, barring no sudden PR’s happen, and then decide if you want to take a position. I’ve learned this helps me to cut down on FOMO allows me more time to form a trading plan. Sure I miss out on plays sometimes, but it’s just my style so take it with a grain of salt. Sorry, got sidetracked there. I want to see a solid break over 1.94 tomorrow and ideally at least a $1 touch. If we can break over $1 then not out of the question for 1.20s.

$CPAH – This one caught my eye while going over chart setups earlier. If you look at the daily chart, it seems to be consolidating around the 2.00 – 2.05 area so keep this on your watch list for a reversal. I am going to set alerts at 2.5 so I can monitor it more closely, but for now it is hard to tell which way it will go at this point.

$CLSD – I am keeping this one on high watch for the break of 3.95 for a possible run to 5.00. Yes, this chart also has several unsavory things like a higher RSI (82.47) and it trades a little choppy. With that being said, this is a speculative play that I am monitoring as it seems to have recovered fairly well after the huge gap down at the end of 2018.

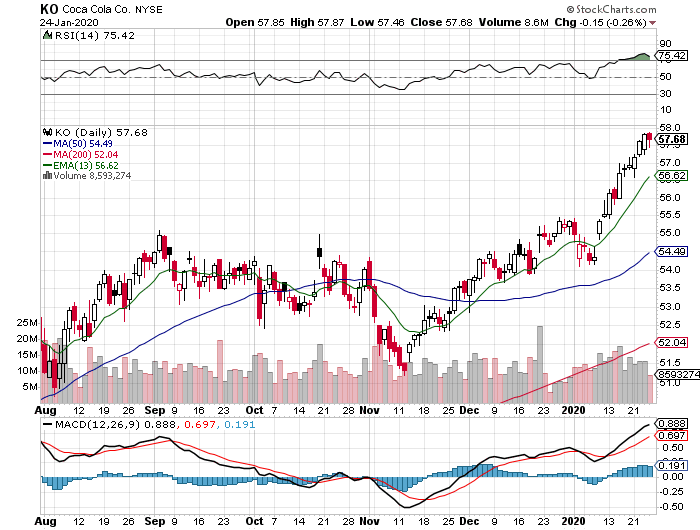

Options Watch List:

$KO – Alerted this one previously in the mid 57’s before the ER. Today the ER was fairly well received as Coca Cola broke over 58 and almost 59 today. I will be eyeing $60 call options tomorrow both weekly and those a few weeks out. If momentum continues it is not out of the question to see over 60s soon as new 52 week highs.

$SPY – Going to be a little risky tomorrow and play lotto calls due to ER season. Both $TSLA and $AMZN knocked it out of the park to looking for a boost back in the 330s on the $SPY.

Sorry about the rough watch list tonight, but I want to try and get my ideas out there before the trading day tomorrow. Plus, it is my birthday today so trying to spend a little more time with my girlfriend and then go home to my wife! Totally kidding haha. Have a great trading day tomorrow and I hope you end the week off strong.

Date: 1/28/2020

Tuesday Recap: Excellent day today! Two tickers, $MGEN and $FCEL, straight from the watch list got traction today with $MGEN doing the standard dip before the rip at the bell. I was able to make a modest profit on this one, but got out too early at 1.68 after the first dip from the initial high of 1.82. I was kinda shocked that it followed the 13 ema on the 5 min chart thereafter and reached the day’s high of 1.97. While I have been fairly good at spotting tickers before the run, one of my goals this year is to relax and let my winners ride a bit. On to $FCEL, I love it when my plan works out as we were watching for the bounce off/near the 50ema and a move back towards $2. While we didn’t touch $2 today, we did end the day with a solid green candle on the daily chart. I am still holding and will swing in anticipation of the $2 break. This was my slow and steady gainer that still has a lot of gas, or I guess hydrogen, in the tank! We will monitor this one the rest of the week.

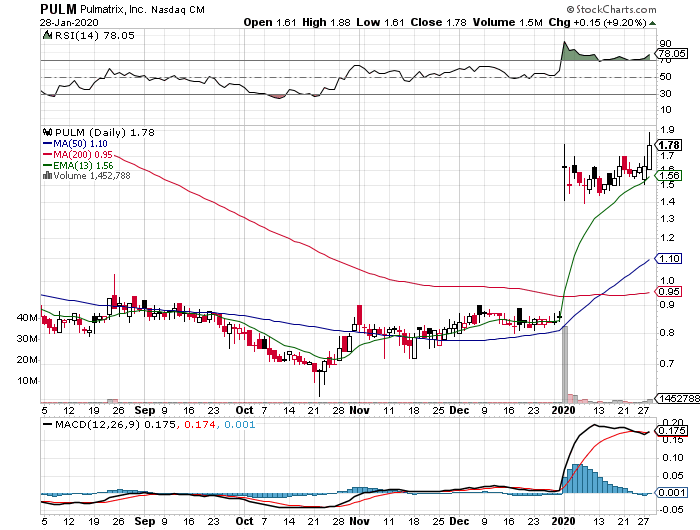

$PULM – A former play from years ago that I really haven’t traded in a long time. With that being said, I have noticed increased volume and price action these past few days. On the daily chart the ticker has held in channel from 1.42 to 1.79 with a decent break over 1.79 today. However, it fell back into the mid 1.70’s, but does appear to have consolidated around this area. Keep this one on watch to see if it can get back in the mid to high 1.80s and then a break over 1.88. In the past this used to rip so let’s see in the old Pulmatrix, Inc. can show back up.

$VBIV – Had this on my favorite’s watch list for a while after the decline from $1.99. The ticker bounced nicely off the 50 ema (1.19) yesterday and also closed higher today forming a confirmation candle on the daily chart. I will have this on high watch for tomorrow to see if continued momentum moves in and crosses over 1.50 and then an eventual break of 1.70.

$CLSD – This ticker has been consolidating well in the $3’s. I put this one on my swing watch list as it usually takes a little time to develop. I am looking for a move back over $3.50 and a strong break over $3.95. I think other traders will see there is room to run to $5 where the stock previously gaped down and try and push it to that area. I do have a few concerns as there are several upper shadow candles which signals this trades very choppy. Ideally, I want this to stay above $3 or there is the possibility of a pullback to 2.72 (13ema, 5 min). For now I will be watching to see how it trades.

If you find this blog helpful, please feel free to share with friends and give it a like on twitter @txjustice3. Also, make sure to follow for upcoming ideas and let me know what you think I could improve for future post. I appreciate it.

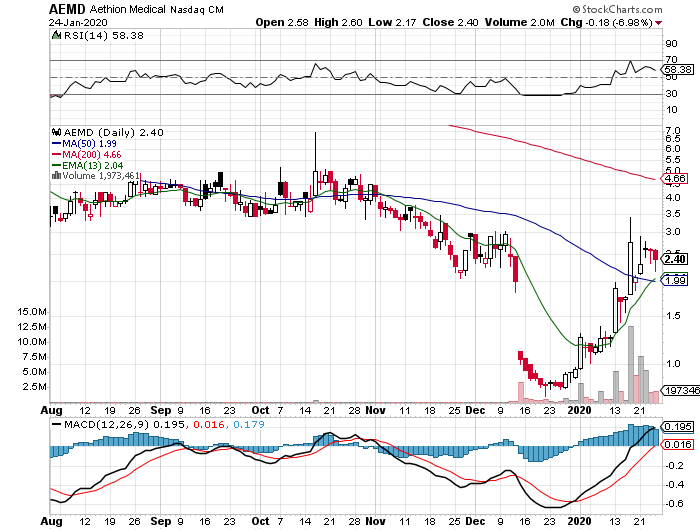

Date: 1/27/2020

Monday Recap: Right from the start Monday presented itself with several challenges and hurdles due to the Corona virus epidemic. I checked the futures right before going to bed last night and have to admit I was a tiny bit worried. With that being said, the S&P 500 has seen massive gains so there was bound to be some sort of a pullback and the Corona virus seemed to be that reason. Despite all of this a few picks off the swing watch list moved up quite nicely. Let’s start with $AEMD, this one far exceeded my expectations as I love it when tickers do exactly as predicted. After having a morning dip, we were able to have a beautiful Red to Green move breaking over pre-market highs (2.87). After the 100ma break on the daily chart it was game on! Very strong close as it seems that traders really want a 200ma touch. Congratulations to those that were able to catch this bad boy! $ADXS while this didn’t have knockout gains like $AEMD, it was able to consolidate all day and get back into the .80’s. This is the make or break area in my opinion as it needs to bounce here right above the 50ma on the daily chart. I want to see a strong bullish engulfing candle tomorrow for a move back towards $1. Lets see how the rest of the week goes.

- Trading Picks:

$MGEN – I was eyeing this one all day to see how it would trade after having a crazy move last Friday. Honestly, I thought we would see a pullback to the .70’s, but was kinda impressed with the slow and steady gains. The last 30 min of the market were very telling with the surge of volume and a high of day at 1.63. What was more impressive was the after hours consolidation above the 200ma (1.47). If we can hold above 1.50 tomorrow, it is not out of the question to see a push towards $2 if volume continues. However, there are a few factors that you should take into account: the RSI is a little high at 85.16 which leans more on the overbought side. Another concern is that if 1.50 doesn’t hold there is a lot of room to fall with the 13ema, 50ma, and 100ma all in the .60-.70 range. Float: 23.81M (Current price: 1.60)

$FCEL – Old play I had a lot of fun with both swinging and scalping that resulted in a nice payout. The reason I like this play again is due to the Corona virus panic, we were able to get a very enticing dip back down towards the 50ema on the daily chart. I am keeping this on watch to see if it can get a bounce from this area, consolidate, and then U-shape back over $2. Yes, this is a large float play, but this ticker also has partnerships with very powerful companies such as Exxonmobil so I don’t think this is it for Fuel Cell Energy. Most seasoned traders know the profits that can be made from this ticker once hype flows back in so definitely one to follow. Float: 210.86M (Current price: 1.60)

$SPY – Going to keep it short and sweet, now that we had a significant pullback I am looking to play this both ways as long as volatility is there. Last Friday, I was able to play puts and calls using weekly options. Now I am not here to tell you what to do, but merely give my opinion and thoughts on particular trades and I will not beat around the bush and act like this is a sure thing. This is a very risky options strategy that I use from time to time. Nonetheless, the $320, 1/31 exp puts look good at the moment. Depending on how the morning futures are, I will be looking to buy a few contracts after the morning sell off and on the first pop. While I am more of a long biased trader, I do like to play both ways on the $SPY if the opportunity presents itself.

Date: 1/26/2020

- Swing Picks:

$ADXS – Recently this bio ticker has taken a slight beating from its previous high of 1.48 , but appears to be attempting a bounce off of the 50ema (.83). Keep this on watch for a possible reversal and retest/break of $1. Recent Jan. 21st offering was priced at $1.05 so not looking for a grand slam but a quick scalp if the conditions are right. Float: 49.95M (Current price: .91)

$ IBIO – I typically stay away from tickers under .50c; however, IBIO appears to show a slow and steady uptrend on the daily chart. Keep on watch for a move back into the .30s and a continuation towards the 200ma (.55). Key areas to break over .34. Float: 23.63M (Current price: .29)

$AEMD I kept this one on high watch after that sudden offering management decided to drop on 1/17/2020; however, despite dropping to the mid .70’s, the stock has managed to make a slow and steady recovery back over the 50ma (1.99). I am watching this week for a bounce back towards $3+. There is strong support near $2 so keep on watch for now to see how this trades throughout the week. Ideally, I would like to see a strong bullish engulfing candle on the daily chart and a steady trend back over the 100ma (3.01). (Current price: 2.40)

$KO – Blue chip stock that has been hitting consistent 52 week highs since the beginning of January. I was actually surprised of the surge in volume and price after $57 break, but I guess that is a good problem to have. I have this on watch for the $58 break and a quick move to $60. I have been monitoring the call options on this one and if you are feeling a little bit risky it wouldn’t be a bad idea to pick up a few lotto calls. (Current price: 57.65)

$FPAY – I have a love/hate relationship with this stock as Lease to Own tickers are not sexy by a long shot, but they have been pretty reliable plays. I have been in and out of this play since .85c and I can say with certainty that patience is a virtue when it comes to Flexshopper. The fundamentals are very strong as I have not seen many profitable penny stocks with quarter over quarter revenue increases. Recently the co-founder, Brad Bernstein, stepped down as CEO not due to mismanagement or corruption, but because he understands his limits and has brought in a very experienced Richard House, Jr. Bernstein has assumed the position of President and will oversee product development, new customer initiatives and other operational areas. If you can stand the wait this one is worth keeping on a favorite’s watch list. 2.10 has held up as support and 2.70 has been past resistance. Float: 9.37M (Current price: 2.44)